Online business loans have become one of the fastest and most convenient ways for entrepreneurs to raise funds. But, as with any financial product, you must ensure that you borrow safely. Are online business loans safe? Let’s discuss key safety tips to help secure your business and personal information while borrowing online. This is especially important for self-employed individuals seeking business loans to grow their ventures.

Choose respectable lenders.

Online business loan application: It is very important to select a reliable lender. The lender must be licensed and registered under some statutory bodies governing finances. Also, research their reputation online and ensure they offer straightforward terms and conditions.

| Red Flags | Signs of a Reputable Lender |

| Unclear loan terms | Transparent and straightforward terms |

| No regulatory license or approval | Licensed and regulated by authorities |

| Poor customer reviews | Positive reviews and a good track record |

Watch for high interest rates and hidden fees.

Online lenders usually charge much higher interest rates than conventional banks. If you can compare rates and know what other fees are involved, you won’t make costly mistakes.

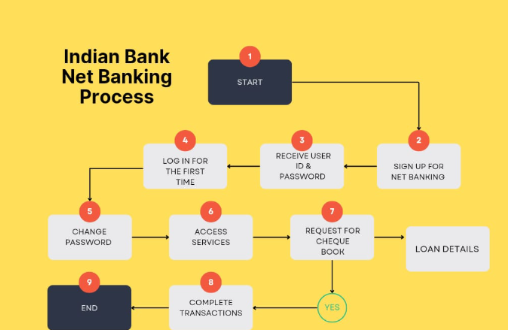

Read More :- Indian Bank Net Banking

Example of Interest Rate Impact:

Here’s a comparison of monthly payments for a ₹3,00,000 loan over 3 years with different interest rates:

| Interest Rate | EMI (₹) | Total Repayment (₹) | Total Interest (₹) |

| 10% | 9,660 | 3,47,760 | 47,760 |

| 15% | 10,900 | 3,92,400 | 92,400 |

Even a small increase in the interest rate can produce much higher payments.

Check if the Site is Secure

Before entering personal or financial information, the lender’s website should have a secure lock. Check to see if “https” is in the URL and for a padlock in the browser’s address bar. Those are indicators that your information is encrypted.

Read the Fine Print about Loans

Always read the fine print of the loan agreement. Be sure to know what interest rate, schedule for repayment, fees, and any penalties for paying back before or after due dates exist. Avoid unclear term loans.

Be Cautious with Lenders Charging Upfront Fees

No legitimate lender charges upfront fees before approving or disbursing loans. If any lender asks you to pay an upfront fee, beware-it may be a scam.

| Red Flags | Signs of a Legitimate Lender |

| Request for payment before loan approval | No upfront fees or charges before loan approval |

| Vague or unclear terms | Clear and detailed terms and conditions |

Check Customer Reviews and Testimonials

Look into a lender’s reputation by reading other customer reviews and testimonials to get an idea of the lender’s reliability and transparency, as seen by other borrowers.

Monitor Your Credit and Bank Accounts

After getting a loan online, always check your credit score and your bank statements for any suspicious activity or unauthorised transactions.

Keep in touch with new regulations and scams.

The online lending space is constantly evolving, and new scams can emerge. Keep updated on the latest regulations and reports of fraudulent lending activities to protect your business from potential risks.

As per a 2023 report, 10% of all online loan applications involve fraudulent activity or scams.

Conclusion

Online business loans are pretty convenient ways to raise finance. But it is important to borrow safely. Suitable lenders, understanding the terms of a loan, and watching out for red flags are what can minimise your risks as well as make things safe for your business.

Read the fine print, avoid upfront fees, and stay informed about potential scams. These steps will ensure you borrow securely and maximise the funding available to grow your business.

Frequently Asked Questions

Q. Are online business loans safe?

Yes, if you select the best lenders and check the terms.

Q. How can I avoid scams when applying for a business loan online?

Find licensed lenders and never pay upfront fees.

Q. What should I check before applying for an online business loan?

Review interest rates, repayment terms, and lender reputation.